End your day informed with the Mo Newsletter.

A daily deep-dive and roundup of the most important and interesting headlines.

In your inbox every weekday.

All Newsletters

Tensions Flare In Minneapolis After ICE Shooting; VP Vance Says Officer Has "Immunity"

The day after an ICE officer shot and killed a 37-year-old American citizen in Minneapolis, federal and local officials are clashing about what caused the shooting— and who should be involved in the investigation into what happened.

ICE Agent Fatally Shoots Woman In Minneapolis; Mayor Tells Feds To 'Get The F*** Out'

A 37-year-old woman was shot and killed during a federal law enforcement operation in Minneapolis on Wednesday.

Trump Looks At Using U.S. Military Power To Acquire Greenland

President Trump and his team are considering “a range of options” in order to acquire Greenland — including “utilizing the U.S. military,” White House press Secretary Karoline Leavitt said Tuesday

Venezuelan Dictator Makes First Court Appearance After U.S. Capture

Venezuelan President Nicolás Maduro and his wife, Cilia Flores, appeared in a Manhattan federal court Monday, following a dramatic overnight operation that culminated in their capture by American troops early Saturday morning.

Your Guide to 2026: The Stories We’re Watching In The New Year

We’re one day into 2026 and looking ahead to the stories we expect to shape this year — plus, the curveballs we know are coming.

Could The Iranian Regime Fall This Time? Protesters Call For 'Death To The Dictator'

Thousands of Iranians are taking to the streets of Tehran and several other cities in widespread protests and strikes as hyperinflation is leading to massive price increases and the national currency plunges to record lows.

Viral Video Claiming New Widespread Minnesota Fraud Leads To Federal Probe

Homeland Security and ICE officers are "conducting a massive investigation on childcare and other rampant fraud" in Minneapolis, Homeland Security Secretary Kristi Noem announced Monday.

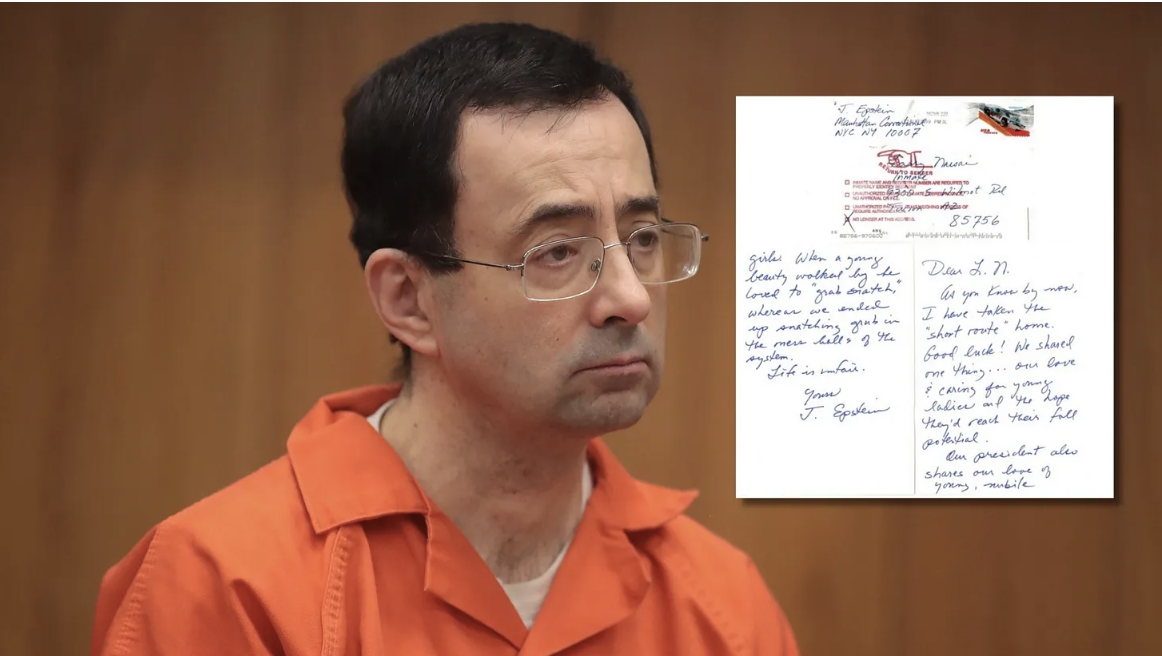

New Batch Of (Real & Fake) Epstein Files Released By Justice Department Include More Trump Mentions

The Justice Department dropped hundreds of more files overnight related to the investigation into Jeffrey Epstein. The new files contain hundreds of references to President Trump— even though the president has not been accused of wrongdoing in connection to Epstein. They had a well-documented friendship in the 1980s, 1990s, and 2000s.

Fallout After CBS Pulls '60 Minutes' Segment Hours Before Air

CBS News delayed a planned and heavily promoted ‘60 Minutes’ segment at the last minute this weekend, triggering internal criticism and accusations over editorial independence at the network.

Brown, MIT Shooting Suspect Found Dead After Reddit Post Helps Cops Crack Case

The suspect in the killing of two Brown University students Saturday and an MIT professor two days later was found dead of a self-inflicted gunshot wound in a New Hampshire storage unit Thursday evening. Now investigators say they’re searching for a motive.

Brown Shooting: Person Of Interest Identified; Possible Link To MIT Professor’s Killing

Investigators appear to have made progress in the search for the Brown University shooter on Thursday, on day six of the investigation. Police say they’ve identified a person of interest and a warrant for their arrest — which you need to show probable cause to obtain.

New Poll Shows Surge in Anti-Jewish Views Among American Youth

“American antisemitism is not primarily a partisan phenomenon, as it is often framed in popular discourse, but a generational one,” writes Yair Rosenberg in an article in The Atlantic, published Monday.

Inside the Explosive Vanity Fair Interview with White House Chief of Staff Susie Wiles

President Trump’s Chief of Staff Susie Wiles spoke extensively — across 11 interviews from Jan. 11 to Nov. 5 — with author and reporter Chris Whipple, offering rare insight into internal debates and her reservations about several Trump policies.

Rob Reiner Murder Investigation Latest; Twin Mass Shootings in the U.S. and Australia

Hollywood legend Rob Reiner, 78, and his wife, Michele Singer Reiner, 68, were found dead Sunday afternoon in their Brentwood, Los Angeles, home in what authorities are investigating as an apparent double homicide.

New Epstein Photos Showing Trump, Clinton Surface As DOJ Faces File-Release Deadline

Democrats on the House Oversight Committee released two batches of never-before-seen photos from convicted sex offender Jeffrey Epstein’s estate on Friday, including images featuring President Trump and former President Clinton.

How AI Is Reshaping How We Work, Watch, and Live

TIME magazine announced Thursday that its 2025 “Person of the Year” is “the architects of AI — the executives and researchers who helped usher in a new era of business, culture, and community shaped by artificial intelligence.

U.S. Looks To Mandate Social Media Checks For Foreign Tourists, Workers

The Trump administration’s newest rules will require foreign visitors and workers to have their social media accounts reviewed before entering the U.S.

Australia Kids Social Media Ban Takes Effect, Will More Nations Follow?

Over a million Australian kids and teenagers under age 16 can no longer access 10 popular social media platforms: Instagram, Facebook, Threads, X, Snapchat, Kick, Twitch, TikTok, Reddit, and YouTube.

The Diddy Doc Is #1 On Netflix — Here’s Why It’s So Controversial

Sean ‘Diddy’ Combs and his entourage are reportedly livid over a new, critical Netflix docu-series about him, produced by long-time rival Curtis ‘50 Cent’ Jackson

Netflix Is Buying Warner Bros: What It Could Mean For You

Netflix has agreed to acquire Warner Bros. Discovery’s film and television studio, along with HBO and the Max streaming service, in a deal valued at $82.7 billion. The takeover would be one of the largest entertainment mergers in history and could reshape the entire streaming landscape.